The battle of the sexes in car insurance

Men are riskier drivers than women. They take more chances, drive faster, and cause more accidents trying to be cool (possibly in a misguided attempt to impress women.) And thus they are more expensive drivers to insure.

It turns out that these gender-based statements may be nothing but old wives’ tales. At least the last one, about men being more expensive to insure. (Please pardon the pun about old wives’ tales, but it was irresistible.)

Our staff at Plutigo.com recently undertook a little research project, gathering quotes from a well-known nationwide auto insurer. We covered 14 states, obtaining quotes for a uniform set of situations:

- 35 year-old men and 35 year-old women

- 65 year-old men and 65 year-old women

In each case, quotes were obtained for six-month policies at three different coverage levels: the state minimum required coverage, a slightly broader range of coverage, and a more extensive “high end” set of coverages.

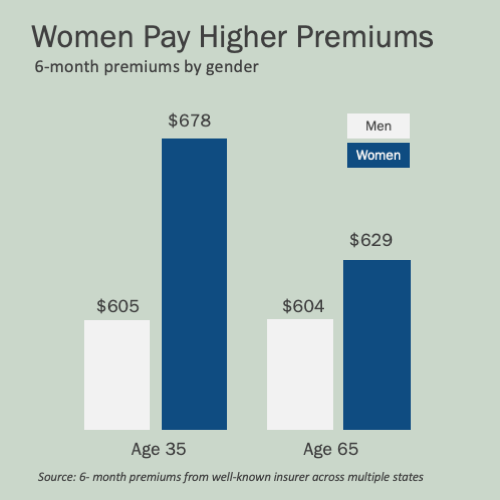

We then averaged the quotes across the three levels of coverage for each of the two age groups, as well as by gender.

The big picture takeaway is that the 35 year-old women are 12% more expensive to insure than the 35 year-old male counterparts ($678 vs $604), and the 65 year-old women are 4% more expensive than the 65 year-old men ($629 vs $605).

When these results were shared within the halls of Plutigo, there is no denying that there was a collective sense of surprise. We are certainly not immune to well-ingrained beliefs above, believing that men are more dangerous drivers due to their testosterone-fueled follies.

To be clear, the results for policy pricing don’t actually disprove these ideas. It’s technically possible that men could indeed be more dangerous drivers due to taking more risk and driving more aggressively, and that the difference is pricing is caused by some other, less obvious reason. But it doesn’t seem highly likely.

Here’s why. Insurance pricing is based on actuarial analysis. This analysis has been around for centuries, and it’s very mathematically complex. In fact, it’s one of the original uses of “big data,” since long before this term had been coined. And as advances in data analysis have been made, particularly in recent decades, they have allowed insurance pricing to become even more accurately reflective of the relative levels of risk from different groups of insured parties.

Translation: the math guys at insurance companies are really good at pricing policies to cover the risk that each customer presents. So if they are charging women more than men, it is a very, very safe bet that women are riskier drivers to insure, meaning that women cost the company more in terms of claims.

In another piece of the research, we looked at men and women aged 25, 35, 45, 55, 65, and 75, both married and single. In another minor surprise, it turned out that the married drivers were on average 8% more expensive to insure.

As far as what age is cheapest to insure, based on our work it appears to be drivers between ages 55 and 65, with our estimate being roughly 60 years of age. For most expensive, it is either the 25 year-olds or the 75 year-olds, depending on which of the three coverage levels you look at. This was certainly not a surprise, as younger drivers are less experienced, while older drivers can be subject to declines in their reaction times and vision.

If there’s a moral to this story, it is probably that insurance pricing models are very complex and incorporate as many variables as possible. We have only looked at a few of the most obvious ones, but there are so many others that factor into the calculation. Some of them make what seems to be perfect sense, and others may be counterintuitive. But the numbers don’t lie.

Taken a step further, each insurance company has its own proprietary models. This is something we’ve all experienced, because while you are a single person whose risk is the same regardless of which website you happen to be looking at, if you get quotes on the same coverage levels from five different insurers, you will get five different results.

Because you aren’t an actuarial mathematician, and even if you are, you don’t know what a given company’s model is going to spit out as a price for your particular situation. That’s why it pays get a lot of quotes before deciding on an insurance company, as we stress so often on Plutigo.com.

And as a final, final word, let us not think that due to our research results the “battle of the sexes” can be put to rest for good. It’s an age-old struggle that helps make life interesting, and it’s certainly not going to be settled by this blog post!